Saved

Sometimes I just can't stop myself, and before I know it, I am poring over spreadsheets with titles like: Estate Tax Returns Filed in 2003: Gross Estate by Type of Property, Deductions, Taxable Estate, Estate Tax and Tax Credits, by Size of Gross Estate.

Consider yourself saved.

I just wanted to see for myself. What level of jack are we talking about with this estate tax?

The data from the IRS for 2003 (estimates based on sample returns) indicate that of slightly more than 66,000 estates over $1 million, only 30,627, worth nearly $110 billion, were taxable. Those avoiding the estate tax weren't only those in the $1-$2.5 million range. More than 7,000 above $2.5 million escaped the tax, including nearly a third of the $20 million-plus estates.

Were family businesses and farms being decimated by the tax? Hard to tell case by case, since farm assets and real estate were separate reporting categories. Let's just say there was more "Art" than "Farm Assets" reported in the taxable returns line, and that "Personal Residences" at $8 billion was almost as high as all the "Other Real Estate," at $10.5 billion, which presumably included more apartment buildings, shopping malls and office towers than grazing lands.

"Closely Held Stock," which could indicate family owned business, represented $5.3 billion of the taxable wealth, or less than 5% of the value of the taxable returns — and less than the $8 billion in cash and more than $50 billion in stocks and bonds held by those estates.

It may make sense to raise the threshold for the tax to cull out a few more of those exceptional cases, and to recognize that "millionaire" is neither the pinnacle nor pejorative it once was. But it's pretty clear who really benefits from phasing out the estate tax.

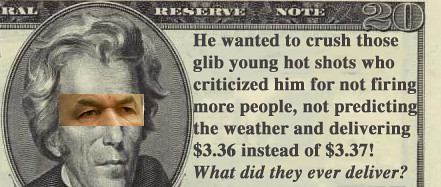

It's the folks like Jeffrey Skilling and Ken Lay, the stars of "Enron: The Smartest Guys in the Room," the movie I saw this evening. I'm not sure I can recommend it. There is not really much pleasure to be gained from watching rich men lie to the people who work for them, but there's a certain fascination in seeing how dead Ken Lay's eyes were as he stood up in front of his managers and told them how excited he was about the future, well after it was clear the ship was going down. And if you ever had the job of putting carefully crafted words in the mouths of executives, it was positively soul-chilling.

After the movie, I stopped in a nearby bookstore. Soon after, another post-show couple came in looking for a book. She was the former executive assistant of a CEO we'd both served in the 1980s. There we were on the second day of screening, all these years later.

Then it struck me. I wasn't there for the Enron story. I was seeking reassurance — maybe even absolution. We got out in time, didn't we? I wanted to say. We got out just in time.

0 Comments:

Post a Comment

<< Home