The Tax Man's Burden

Whether it's gambling, smokes or booze, Minnesotans have a lighter "sin tax" burden than the national average, according to data just released by the U.S. Census Bureau.

The 2004 data, the most recent available, show that Minnesotans pay more in state taxes per capita than residents of most other states — we rank fourth. That's mostly because Minnesotans have higher incomes than residents of many states and because Minnesota relies more heavily on a state progressive income tax than on local taxes.

— "Minnesota's tax burden is ranked 4th in U.S.," StarTribune

Note: I started this post 10 days ago, but was getting too wonkish. This a summary of a too-dense draft.

The article gives a reasonably balanced view of what a state "tax burden" ranking means, but with the focus on sin taxes and the state ranking, most readers are likely to remember just the headline and conclude: Our taxes are too high.

Whether you live in Minnesota or another state, here are some things to keep in mind when you hear candidate rhetoric about high taxation levels.

State taxes are only part of the tax picture. States typically rely on a mix of taxes on personal income, corporate income, property, and sales, along with special taxes on consumption of items like gas, liquor, cigarettes, and gambling. County, municipality, school district and other special district assessments that fund public services may not be included in "state tax" comparisons. Neither are fees and other charges for services.

The Tax Foundation says, "some states accomplish at the local level what other states accomplish at the state level, so a degree of comparability is lost as a result. For example, New York's state sales tax rate is 4 percent, and its counties have local sales tax rates that range from 3 percent to 5.75 percent. Connecticut, on the other had, has a 6 percent state-level sales tax with no local add-ons. In a ranking that includes only state-level taxes, New York appears less taxed than it actually is, and Connecticut appears more taxed."

Tax dollars per capita is a poor basis for comparison. For example, a state with a $20k average income and 12% tax rate would collect $2,400 per capita; a state with a $17k income and 14% tax rate would collect $2,380 per capita. Yet the state taking a higher percentage of income would still earn a better ranking. Minnesota's number four per capita ranking seems reasonable, given our number five ranking for median average income.

What are taxpayers getting for their investment? Comparing tax levels is also meaningless without comparing the level and quality of government services. The kind of life we want should be part of the discussion about what's a fair price for government services.

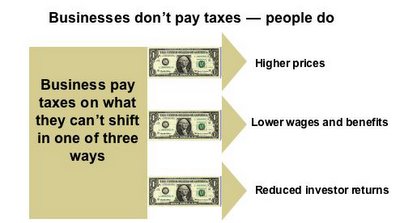

Politicians will pick numbers that support their ideology. Tax foes will use the Census Bureau because of Minnesota's misleading high ranking. Business advocates will cite Minnesota's top five ranking for its corporate income tax rate, even though few businesses in the state pay the corporate tax (accounting for $700 million of $28.8 billion in state revenues). Progressives may push for taxes on business, overlooking that these taxes are typically passed through to consumers.

When candidates start talking about "tax burden," press them to talk instead about the total funding picture. The “Price of Government” index is a better measure of the cost of all general government services statewide. It includes nearly all revenues generated by state and local units of government through state taxes, property taxes, special assessments, fees and charges for services such as licenses, bus fare or tuition.

0 Comments:

Post a Comment

<< Home